News

Inflation and Household Funds in 2023 – Being pregnant & New child Journal

In keeping with the U.S. Bureau of Labor Statistics, in October 2019, a gallon of milk value $3.12, a pound of rooster value $1.54, and a dozen eggs value $1.28. At the moment, a gallon of milk prices $3.97, a pound of rooster is $1.96, and a dozen eggs will run you round $2.07. Now, an additional 85 cents for milk, 42 cents per pound of rooster, and 79 cents for a dozen eggs might not appear that excessive, however if you add these little will increase up with the rise in costs of each different product in a typical grocery retailer run for a household, the invoice grows considerably.

And it’s not simply costs on the grocery retailer which have risen over the previous couple of years—it’s in all places. Between 2021 and 2022, the price of a pack of diapers went up by 20%, child meals rose 11.8%, and automobile seats elevated 41%. Between October 2019 and September 2023, the worth of a gallon of gasoline has risen by $1.32, and pure gasoline (for the house) elevated by 34 cents per therm. The childcare disaster has solely worsened, with a 6% worth enhance between July 2022 and July 2023. Lastly, in 2023, medical health insurance premiums grew 7% from 2022, and so they’re anticipated to extend once more in 2024. The rising prices really feel unattainable to maintain up with, and thousands and thousands of households throughout revenue brackets have had no alternative however to cut back on issues they get pleasure from over the previous couple of years with a purpose to hold their kids heat, fed, and clothed.

Nonetheless, regardless that most of us have felt the results of rising prices, it doesn’t at all times seem that approach. One fast scroll via Instagram will lead you to imagine that everybody is happening lavish holidays, that you just should stow away your skinny denims and put money into wide-leg types if you wish to keep away from wanting like “a boring mother,” and that costly meal supply kits that prevent half-hour at time for supper are well worth the upcharge (on the already overpriced meals). Feeling such as you’re the one one having to chop again on bills can convey an entire flood of feelings. However we’re right here to let you know that you’re not alone, regardless of what it appears. The Being pregnant & New child editorial workforce surveyed practically 2,400 mother and father to learn the way inflation has affected them over the previous couple of years, and the outcomes clearly point out that extra households are battling rising costs than many people notice—in truth, 95% of survey respondents say they’re feeling the results of inflation.

How We Received Right here

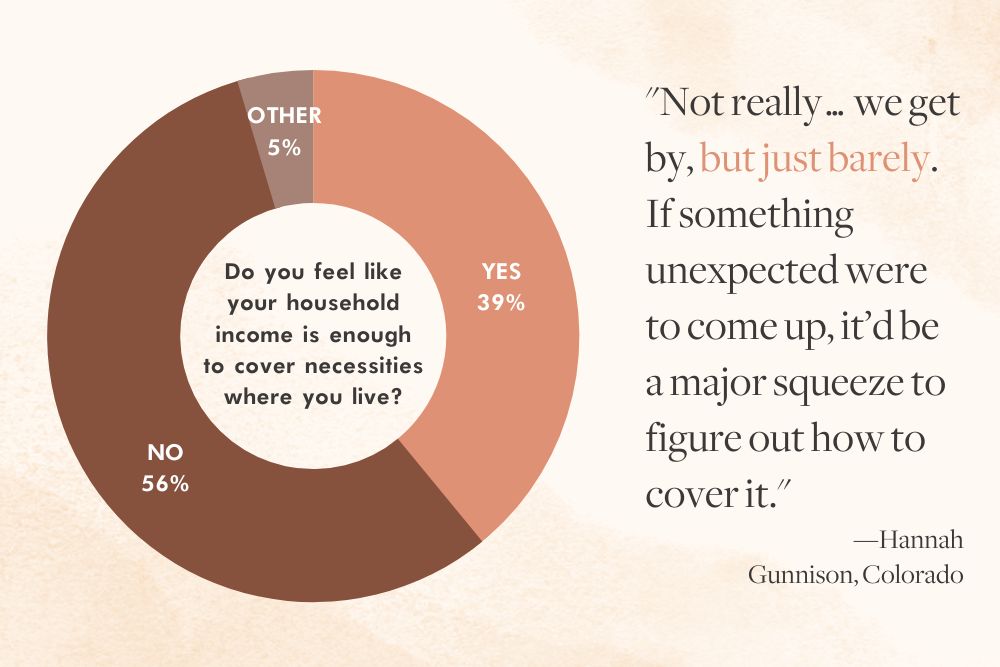

Inflation is nothing new; in truth, it’s to be anticipated. The Federal Reserve goals for an annual inflation charge of about 2%. After all, in some years, inflation could also be just a little decrease or just a little greater than 2%, however total, the Federal Reserve raises and lowers rates of interest to assist management inflation and hold our economic system as regular as doable. Sadly, issues haven’t occurred this fashion in the previous couple of years, and greater than half of our survey respondents say their present family revenue isn’t sufficient to cowl the services required to satisfy their fundamental wants.

With any product, pricing is predicated on how a lot it prices to fabricate the merchandise (together with elements and labor) and provide and demand. When there’s a surplus of provide and low demand, costs are low; when there isn’t sufficient provide to satisfy demand, costs go up. In early 2020, the beginning of the COVID-19 pandemic, a lot of the world got here to a cease. For months, all throughout the globe, employees have been despatched house, factories shut down, and solely important staff have been anticipated to indicate up for in-person jobs. This meant manufacturing in numerous industries got here to a halt, so provide decreased.

Throughout this time, within the U.S., the federal authorities was doing every thing it may to keep away from a fast recession, together with supplementing state unemployment packages, sending stimulus checks to thousands and thousands of households, distributing paycheck safety program (PPP) loans with little oversight, considerably chopping rates of interest (notably affecting mortgages), and providing steep tax cuts to people and companies. This saved the economic system going, however with so many individuals caught at house with nowhere to go and just a little extra cash of their financial institution accounts, they shopped. Quickly sufficient, demand was a lot greater than provide on just about every thing, so costs elevated dramatically.

By the second quarter of 2021, most industries have been near or again to their pre-pandemic output. Nonetheless, between December 2020 and December 2021, client costs (used to measure inflation) rose by 7%, essentially the most vital leap our nation had seen since 1981. Then, between December 2021 and December 2022, client costs elevated once more, this time by 6.5%. Why have been costs nonetheless climbing lengthy after provide had stabilized? This time, consultants say, it was as a result of the variety of vacant jobs was a lot greater than the variety of unemployed individuals, making it a job seeker’s market. This era was labeled “The Nice Resignation,” as thousands and thousands left their jobs for higher pay, higher advantages, and extra development alternatives. As a way to compete in recruiting high expertise, firms needed to enhance beginning wages, leaving customers to foot the invoice with higher-priced merchandise.

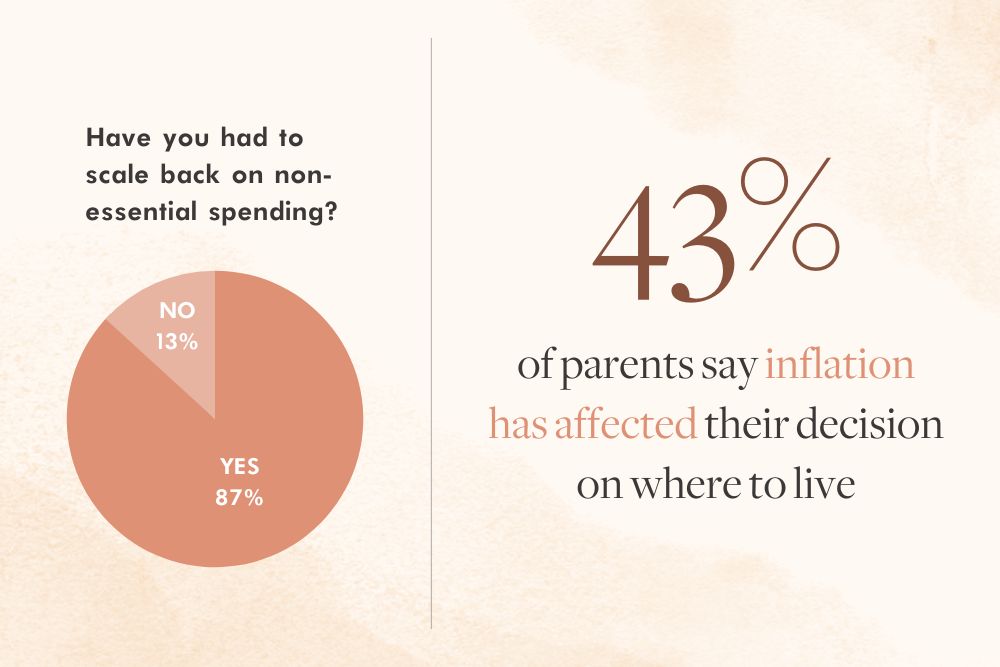

At the moment, the Federal Reserve was additionally within the means of rising rates of interest. Whereas this transfer was meant to assist cool inflation, it negatively impacted mortgages; mixed with years of dramatically rising house costs, it has made it more and more tougher for a household to afford a house within the U.S. Consequently, 43% of our survey respondents stated the rising prices related to inflation have impacted their choice on the place to stay.

Lastly, lots of the particular tax breaks that helped households through the pandemic resulted in 2022, which minimize off spending cash many had come to depend on to assist cowl rising dwelling prices. In our survey, 87% of oldsters reported having needed to cut back on non-essential spending. We additionally requested mother and father how inflation has affected their youngsters’ lives. Various mother and father stated they’re unable to afford childcare, and plenty of expressed disappointment that they’ll now not afford to purchase issues their youngsters get pleasure from. Laken, from Thomasville, North Carolina, stated, “Since [our daughter is] so younger, it’s simpler to cover, however we will’t afford new toys, garments, or take her wherever enjoyable.”

Inflation vs. Company Greed

Between COVID-19, provide and demand struggles, employee calls for, and the struggle in Ukraine, there’s little doubt that there have been numerous contributing elements to the fast rise in costs between 2020 and immediately. However between manufacturing output going again to regular, budgets being adjusted for greater employee salaries, and The Federal Reserve’s rising rates of interest, shouldn’t we be seeing a gentle lower, or on the very least stabilization, in costs? Effectively, that’s the thought—besides these techniques used to stabilize an economic system don’t appear to think about company greed.

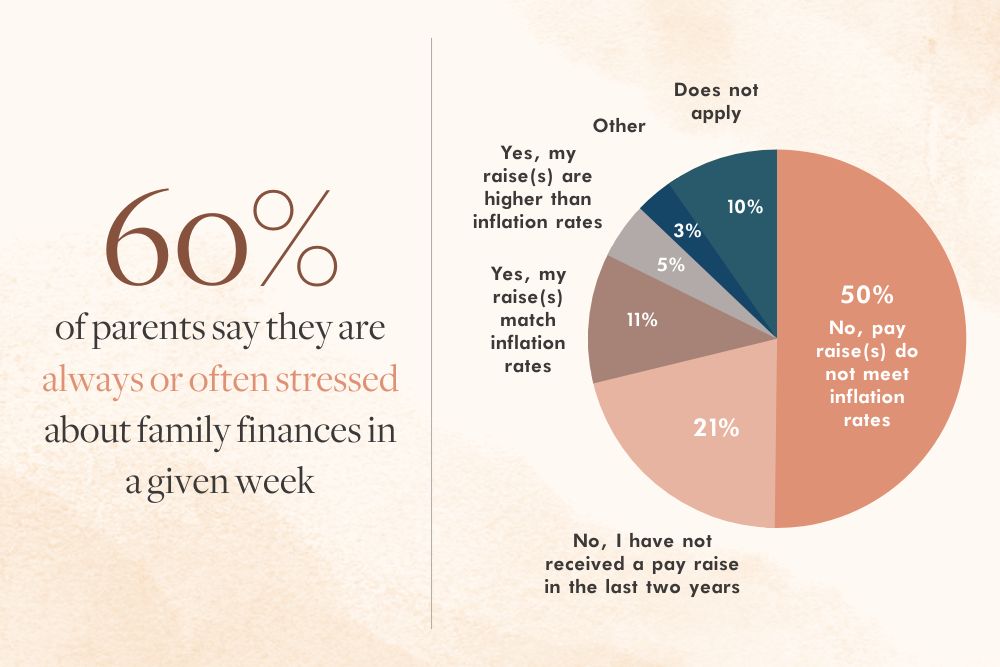

Regardless of firms’ narrative that they needed to enhance product costs with a purpose to enhance employee salaries, between April 2021 and January 2023, wage development didn’t sustain with inflation. Consequently, for lots of the Individuals who have been fortunate sufficient to get a elevate throughout this time, it wasn’t practically sufficient to maintain up with the rising prices. Over 71% of our survey respondents stated that they had not acquired a value of dwelling pay enhance over the previous two years, or in the event that they did obtain one, it didn’t match the speed of inflation. At the moment, wage development is barely greater than inflation, however too many households are nonetheless making an attempt to play catch up from the previous couple of years to really feel any monetary reduction. In reality, many of the mother and father we polled admitted to typically or at all times feeling confused over household funds.

Additional, in Could 2023, the New York Instances reported, “Among the world’s greatest firms have stated they don’t plan to alter course [in raising prices of goods and services] and can proceed rising costs or hold them at elevated ranges for the foreseeable future,” regardless of reporting file income. On the finish of 2022, Basic Mills reported a 16.5% web revenue enhance (bringing the overall to $2.7 billion), and the corporate’s income proceed to develop in 2023.

Equally, Tyson elevated its web revenue from $3 billion in 2021 to $3.2 billion in 2022—and shareholders are being rewarded generously consequently. PepsiCo noticed comparable outcomes, with a 16.9% web revenue enhance in 2022 and continued will increase in 2023.

Trying Ahead

The factor is, firms will proceed elevating costs till customers cease buying them, forcing a lower in value. However not shopping for an excellent is simple when the product is non-essential, and your loved ones will rapidly adapt to not having it; it’s not really easy when that product is milk, warmth, or clothes for little youngsters who develop like weeds.

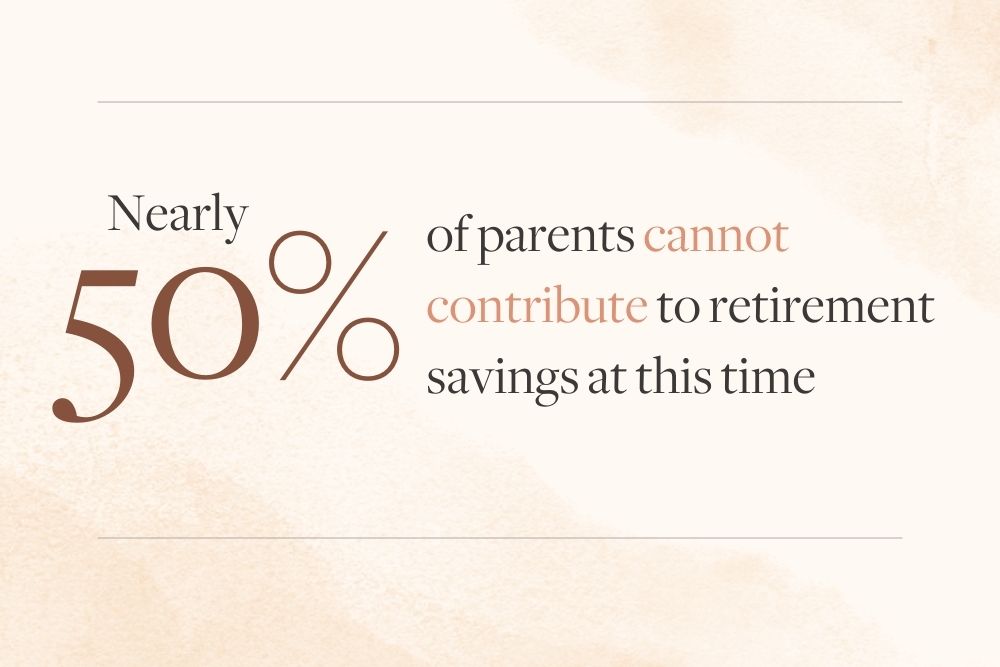

So, what are we alleged to do? As a result of, as our survey outcomes present, happening with enterprise as regular isn’t sustainable for us financially or mentally. Most households are working tougher simply to remain afloat proper now, and plenty of can’t even start to consider monetary planning for the long run. Nearly half of the mother and father who participated in our survey reported that they’re unable to make financial contributions to their retirement financial savings right now. If this pattern continues, thousands and thousands of oldsters might not be capable of afford retirement and probably face turning into financially incapacitated by surmounting debt.

The excellent news is, whereas it could not look like it, costs of some items and companies have steadily decreased during the last yr. As a lot as we’d all like just a little respiratory room, a gradual discount is finally higher for the economic system as a result of a quick “deflation” is often the results of a “very extreme recession,” in keeping with an NBC interview with economist Michael Pugliese. As of July, The Federal Reserve initiatives inflation to stay above 3.5% via 2024. This will likely sound grim, however take into account that inflation in 2023 is at present at 3.7% (considerably higher than 7% in 2021 and 6.5% in 2022), so the 2024 projection continues to be a discount. The method is gradual, however it’s working.

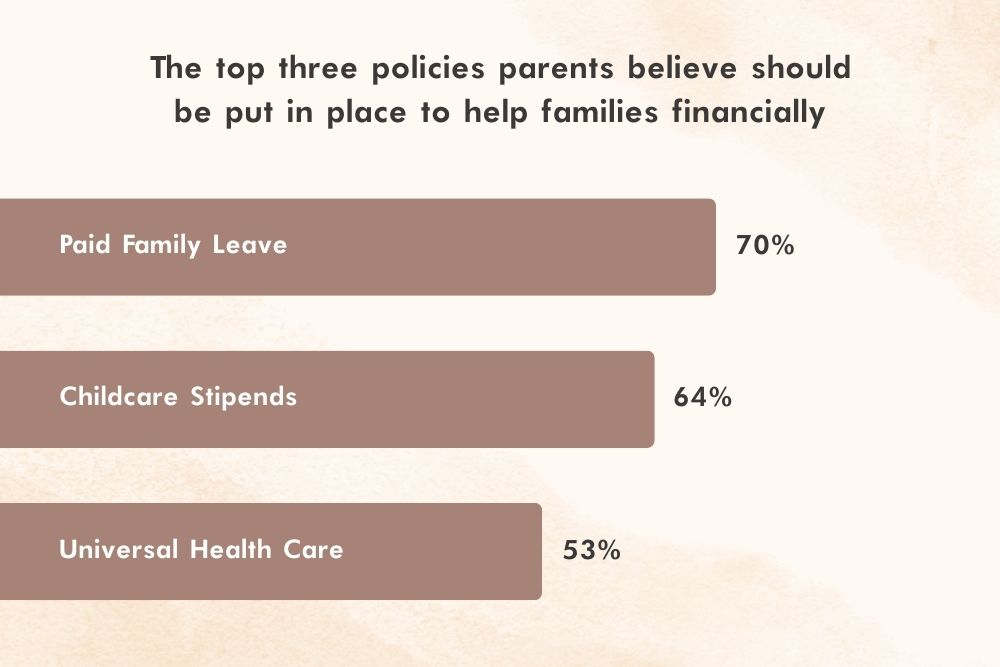

The consequences of inflation are being felt nationwide, and we’ll probably proceed to see them unfold for years to come back. With this vital lower in spending energy (which notably hurts lower-income households), there’s no higher time than now to reassess how we do issues on this nation and what security nets we now have in place for our residents. As a substitute of providing tax cuts to the wealthy to stimulate “trickle-down economics,” the mother and father we surveyed produce other concepts—like paid household depart, common healthcare, and childcare stipends, to call a number of. Because it stands, too lots of immediately’s mother and father are unable to economize for an emergency or retirement, can’t repay pupil loans, aren’t capable of put aside cash for his or her youngsters to go to varsity sometime, can’t buy a house, or probably even develop their households regardless of desirous to. We might not be capable of do something concerning the inevitability of inflation, however we can vote for politicians who will advocate for us and put insurance policies in place to make sure households are capable of survive financial modifications.

We’d prefer to thank the two,394 mother and father who participated in our survey. Your enter is valued, and we respect your willingness to share your tales with us. For those who’d prefer to take part in future editorial initiatives for Being pregnant & New child, subscribe to our e-newsletter for normal updates and alternatives.

The put up Inflation and Household Funds in 2023 appeared first on Being pregnant & New child Journal.

[ad_1]

Authentic Supply: http://www.pnmag.com/news-advocacy/inflation-affecting-families/?utm_source=rss&utm_medium=rss&utm_campaign=inflation-affecting-families

Written by: Ashley Ziegler on 2023-12-06 20:11:39

[ad_2]

You must be logged in to post a comment Login